Introducing the ETH Gas Price Market - Hedging Against Rising Gas Costs

By Walodja1987 at

TL;DR: This article introduces an innovative product that offers insurance against rising gas costs on Ethereum, powered by DIVA Protocol.

Gas serves as the fuel that powers the Ethereum ecosystem. With each transaction conducted on the Ethereum network, users are required to pay for the consumption of gas. However, the price of gas is far from stable and fluctuates based on transaction demand. In times of heightened economic activity, gas prices soar, placing a burden on network participants.

Recognizing the need for a solution to offset the rising gas costs, we are proud to introduce the ETH Gas Price market, an innovative solution powered by DIVA Protocol that offers network participants insurance coverage against rising gas prices.

⛽ Understanding Gas on Ethereum

Gas is a metric that quantifies the computational effort needed to execute transactions on the Ethereum network. The amount of gas required depends on the complexity of the transaction. Simple transfers demand less gas compared to more complex operations. Gas prices are denominated in Gwei, which represents a fraction (1e-9) of Ether, Ethereum’s native currency.

The Ethereum network imposes a limit on the amount of gas available for each block, currently set at 30 million. This capacity restriction causes the gas price to fluctuate based on the level of economic activity within the network.

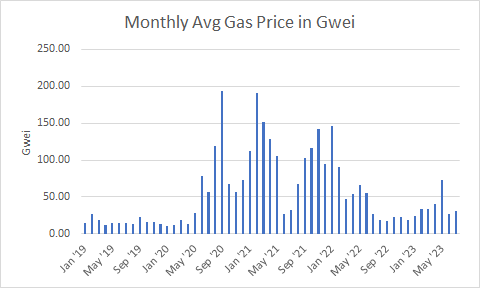

The chart below illustrates the average gas price per month, starting from 2019 (Source: Etherscan as of 11 July 2023):

In 2019, the average gas price was around 16 Gwei. The “DeFi summer”, that started in the second half of 2020, brought unprecedented activity, leading to a significant surge in monthly gas prices, reaching levels between 50 and 190 Gwei for the most part. The collapse of LUNA, 3AC, and FTX in the second half of 2022 sent shockwaves throughout the crypto space, leading to a decline in economic activity on Ethereum and a retreat of gas prices to the range of 20 to 30 Gwei, which has persisted until the present day.

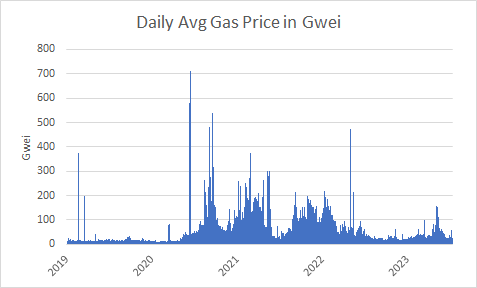

On a daily basis, gas prices may exhibit more significant fluctuations, typically as the result of increased transaction activity surrounding highly anticipated events, such as long-awaited NFT mints or token sales, or liquidations. This is demonstrated in the chart below for the same period (Source: Etherscan as of 11 July 2023):

🤕 Problem

The increasing costs of gas on the Ethereum network have substantial implications for frequent users. One notable example are centralized exchanges that process thousands of on-chain withdrawals on a daily basis.

According to data from Nansen as of 19th July 2023, Binance, one of the largest crypto exchanges, has incurred a total of 320 ETH in fees in processing withdrawals over a 7-day period. This equates to approximately $600,000 per week and extrapolates to $2,400,000 per month.

These figures are significant considering the current low fee environment where gas fees range between 20 and 30 Gwei. During times of heightened network congestion where gas fees can spike to levels of 50-100 Gwei or even higher, these amounts can quickly escalate.

To accurately reflect actual cost, centralized exchanges regularly update their withdrawal fees to align with the prevailing fees on the network. However, frequent adjustments and, notably, significant increases in fees, such as those observed in 2018 and 2020 by Binance, are generally unpopular with users and can result in challenges in attracting new clients. In addition, withdrawal fee increases coupled with the inherent volatility of fees poses a risk of overcharging clients, further contributing to their dissatisfaction.

💡 Solution

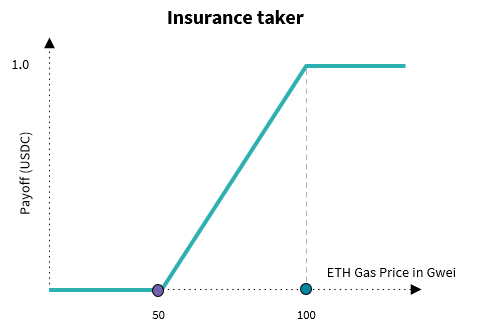

To address the challenge of fluctuating gas costs, an effective solution is the introduction of an insurance product that provides compensation to users when the gas price exceeds a predetermined threshold, thereby stabilizing overall costs and mitigating risks associated with price spikes.

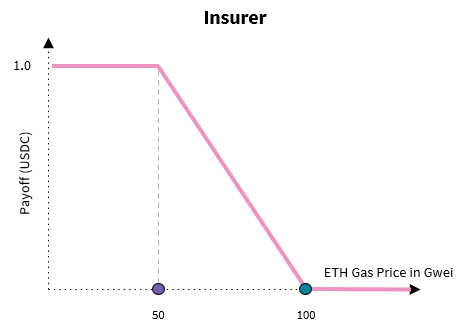

The following chart illustrates an example product with a linearly increasing coverage payout in the range of 50 to 100 Gwei:

By purchasing this insurance product, network participants can effectively offset increasing gas costs within that range. For Binance, this reduces the need for frequent updates to withdrawal fees in response to gas price spikes, providing stability and predictability for both Binance and its users.

🤝 Counterparties

To enable insurance coverage, there needs to be a party, known as the "insurer", who is willing to provide insurance cover of up to $1 per contract in exchange for a premium.

Visually, the insurer's payoff is the reverse of the insurance taker's and is illustrated in the chart below:

The following market participants may serve as natural counterparties to insurance buyers:

- Validators: Ethereum validators anticipating low gas prices can sell their potential upside participation in the event of increased network activity and higher gas fees. If gas prices remain low, validators retain the premium received from selling the insurance cover. If the gas price surges, the increased revenue from gas fees will be offset by a loss in their position, thereby limiting their upside potential.

- Yield seekers: Individuals who believe that the bear market will continue and economic activity on Ethereum will remain low.

📈 Market creation

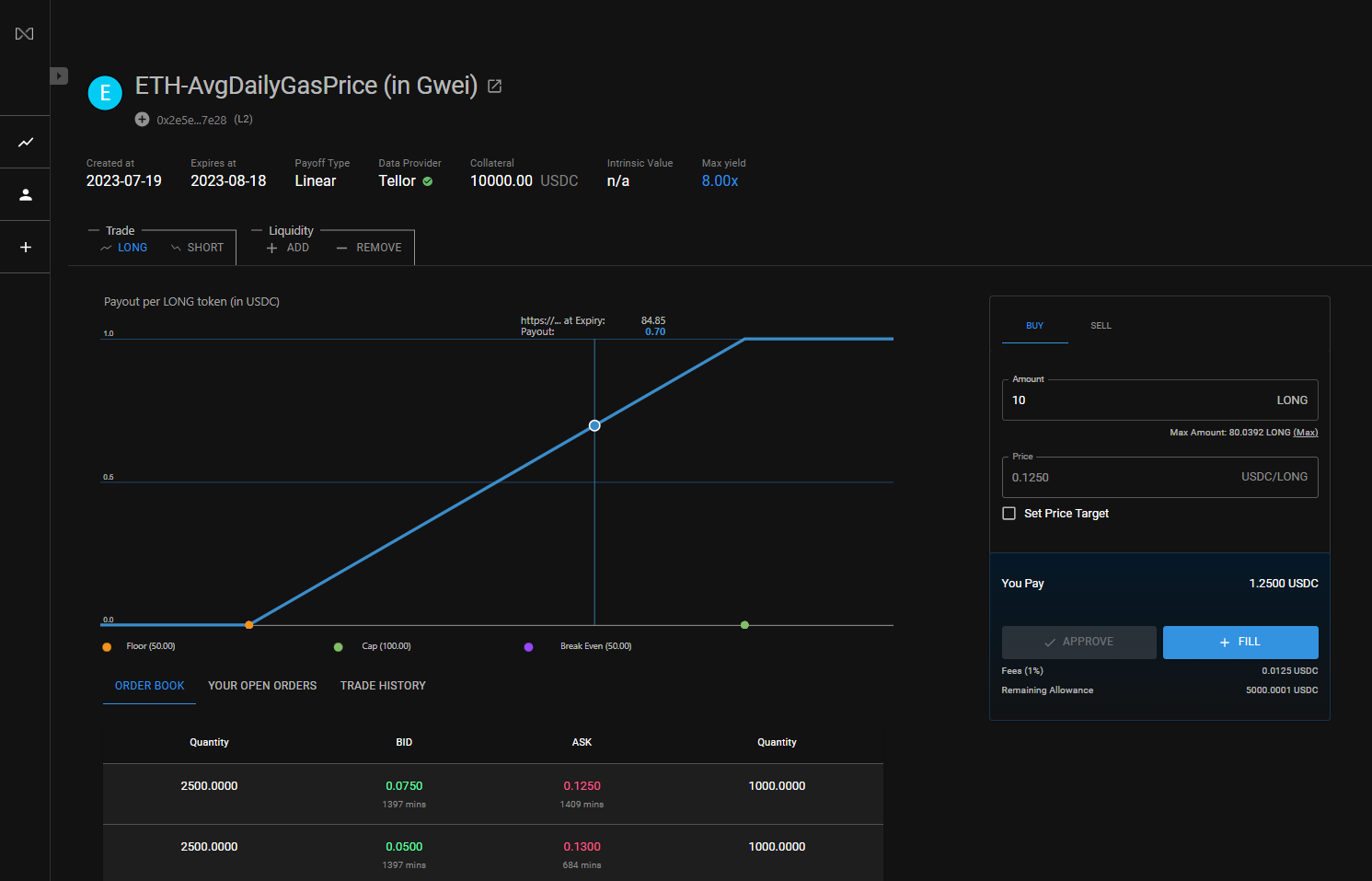

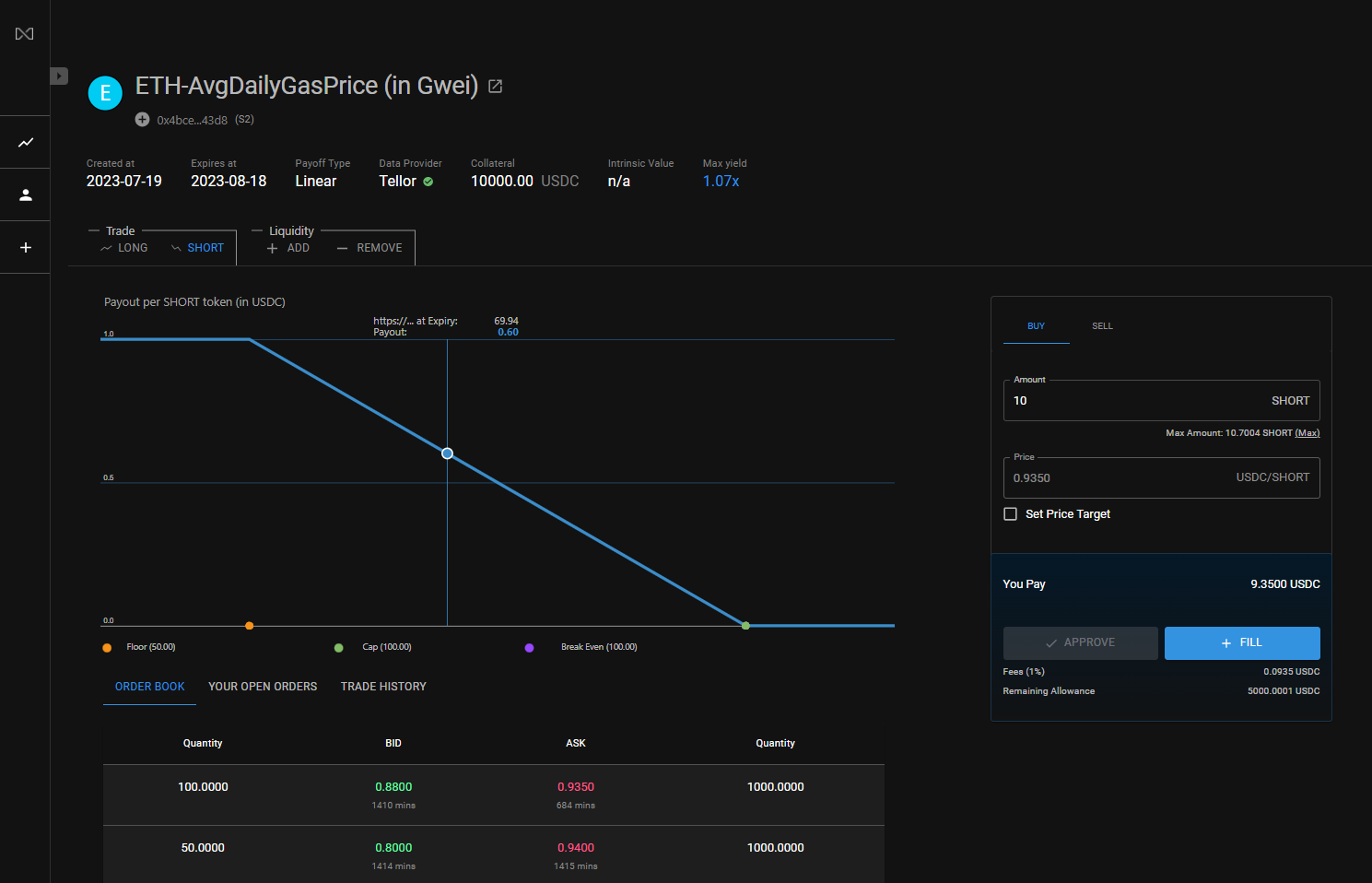

DIVA Protocol was used to launch the first ETH Gas price market with the following specification:

- Underlying: The arithmetic mean of the average daily gas prices on Ethereum in Gwei during the specified timeframe, starting from the calendar day associated with the start time and ending on the day before the calendar day associated with the end time. Note: The underlying description is stored as a json file on IPFS and referenced as the reference asset in DIVA Protocol.

- Payoff: Linear in the range of 50-100 Gwei

- Duration: 1 month

- Start time: 19 July 2023, 9:33pm UTC

- End time: 18 August 2023, 10:59am UTC

- Oracle: Tellor protocol

- Collateral asset: USDT

- Network: Polygon

Each side of the market (insurance taker and insurer) is represented by an ERC20 token, allowing for seamless integration and tradability within existing decentralized infrastructures. The DIVA App serves as a user-friendly platform for trading these insurance contracts, powered by the 0x Protocol, a decentralized limit order book protocol.

Users who are interested in purchasing insurance coverage can either fill existing sell orders (Ask) or place their own limit orders (Bid) in the LONG token market.

Users who are interested in providing insurance coverage can either fill existing sell orders (Ask) or place their own limit orders (Bid) in the SHORT token market.

🌔 Conclusion

The introduction of the ETH Gas Price market on DIVA Protocol brings much-needed relief to Ethereum users affected by rising gas costs. By offering an insurance product as a hedge against gas price fluctuations, DIVA Protocol empowers projects and individuals to protect themselves from the financial burden associated with on-chain operations.

📃 Disclaimer

The use of Binance as an example in this article is purely for illustrative purposes. We have not collaborated with Binance or been in touch with them for the creation of this article. The mention of Binance is solely to provide a practical scenario and does not imply any endorsement or affiliation.

Further, the ETH Gas Price market is designed to offer insurance coverage and hedging options to users. As with any financial instrument, participants should conduct their own research and exercise caution when engaging in trading activities. DIVA Protocol does not guarantee any specific outcomes or returns and encourages users to make informed decisions based on their own risk tolerance and objectives.

🔗 Links

- 🌐 Website: divaprotocol.io/

- 🍏 Github: github.com/divaprotocol/diva-protocol-v1

- 📚 Docs: docs.divaprotocol.io/

- 🦜 Twitter: twitter.com/divaprotocol_io

- 🤖 Discord: discord.gg/8fAvUspmv3